Building financial data infrastructure through open banking

General ·Notes from a speech at a Thomson Reuters_-hosted ODI Futures events on the future of financial data infrastructure. The event also included the launch of an ODI Labs paper on blockchain technology.

Data is infrastructure. Just like roads. Roads help us navigate to a location, data helps us make a decision. In the industrial revolution we learnt how to build good road infrastructure. In the digital revolution we need to learn how to build good data infrastructure.

Our road infrastructure is more than just the roads. It includes road signs that describe a particular piece of road. The highway code that tells us how we should all behave. Organisations that maintain roads and make sure they’re there when we need them. When there are potholes and road blockages, there are people whose job it is to fix those problems. Today, we can help too. Apps like FixMyStreet let us take pictures of potholes and send them to our local councils.

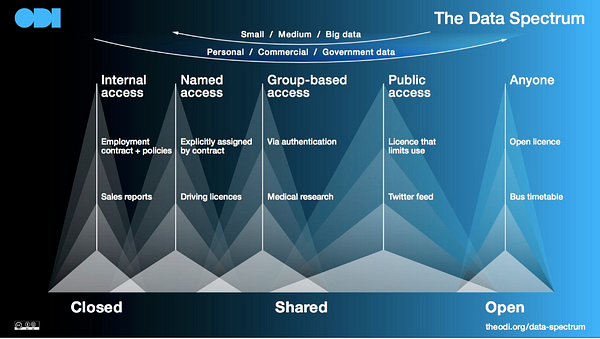

Similarly, our data infrastructure is more than data. The data is important — and that data comes from across the spectrum of closed, shared and open data — but data infrastructure includes the technology, processes and organisations that help us publish, discover, maintain and use that data.

Technology such as blockchains and open APIs. Processes such as data protection legislation or training to help people understand how to use data ethically. Organisations such as the ODI or each of you in the audience today. I suspect that everyone here today either maintains or uses financial data infrastructure. If you have a bank account then your data is in that infrastructure.

Data infrastructure connects multiple sectors. To give some examples from around the financial sector. Economic statistics are used by banks to make decisions about investments. Flood maps are used by insurance companies to set premiums. Property ownership records are used to understand credit risk. Informaton about mortgage products is used by banks, regulators and customers to make decisions.

But we need to learn how to strengthen data infrastructure. There is too much data that is poorly maintained, inaccessible or that costs too much money to access.

When strengthening data infrastructure people, businesses, governments and societies will face choices. These choices might lead us to different data futures.

We might choose a locked-down future. One where organisations misuse data in ways that we find creepy whilst we continue to see hacks and security breaches due to poor security. This leads to people choosing to withdraw their data and reducing how much they interact online. Think of it as a data infrastructure dominated by missing roads and communities with padlocked gates. It creates the least value from data.

Or a paid future. One where everyone expects to pay for access to data and to be paid for access to their data. Imagine the costs of managing all of those transactions and licences. It’s a data infrastructure with toll booths every 100 yards. This may be the future we are heading towards right now. It’s flawed.

At the ODI believe we should choose something else: an open future. One where our data infrastructure is like our road system. The data infrastructure is as open and navigable as possible. Open data will be maximised, while privacy is respected. We believe this future creates the most value. It creates a virtuous circle from which everyone can benefit.

But analogies only go so far. We won’t build better data infrastructure using the same techniques we use for road infrastructure. To give a simple example the M25 was first proposed in 1937 in Sir Charles Bressey’s and Sir Edwin Lutyens’ The Highway Development Survey. It was completed 49 years later in 1986.

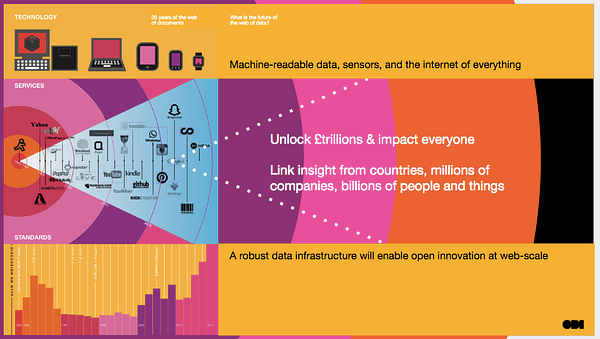

None of us can take that long to plan and build better data infrastructure. The web moves too fast. The web has only been around for 25 years and look at what it has delivered. The web of data is the next stage in its evolution.

Lots of people are helping building this open future and the web of data with the open banking standard. Last year about 150 people from a huge range of organisations collaborated and worked in the open. In just 3 months they agreed a way to make retail banking data as open as possible whilst keeping private what should be private.

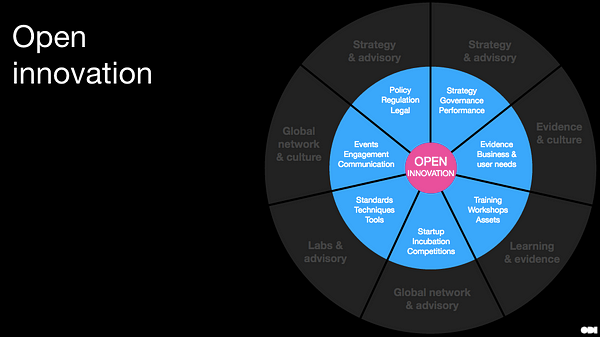

To implement the framework the community will need to work together to understand the needs of differing stakeholders, develop open standards, publish open data about products and branches, create open APIs for sharing personal data with people in control, develop guidance for compliance, rollout training, to run innovation challenges to test the standard and stimulate the market and communications to make sure everyone knows what’s happening.

The prize for completing this work is big. A data infrastructure which is as open as possible, such as the one developed by the open banking standard, will enable open innovation at web-scale.

The standard will help customers to look for a mortgage more easily, banks to find customers matched to a new product, and businesses to share data with their accountants. The uses won’t be limited to the UK retail banking sector. People have talked about using the data in the UK’s decentralised identity framework; or to help people who move country and need to create a new banking account or rent a flat. The standard will allow these, and many other services, to be built whilst respecting privacy, putting customers in control of their data and creating trust.

People want those services and open innovation creates opportunities for businesses. Good data infrastructure which is as open as possible is a competitive advantage for organisations, cities, sectors and nations.

The open banking standard helps build that infrastructure and is part of that competitive advantage. It’s part of the open future for financial data infrastructure.